Breaking News

Chinese Antimony Restrictions: A New Strategic Challenge for Western Defense Industries.

On September 15, 2024, China will implement new restrictions on antimony exports, a metal essential for the manufacturing of both defense and civilian technologies. This decision marks a turning point in the global battle for control over critical minerals, a confrontation deeply rooted in the increasing technological rivalry between China and the United States. Antimony, though relatively unknown to the public, plays a crucial role in the production of various military equipment, further emphasizing the impact of these new measures, particularly on U.S. national security.

Follow Army Recognition on Google News at this link

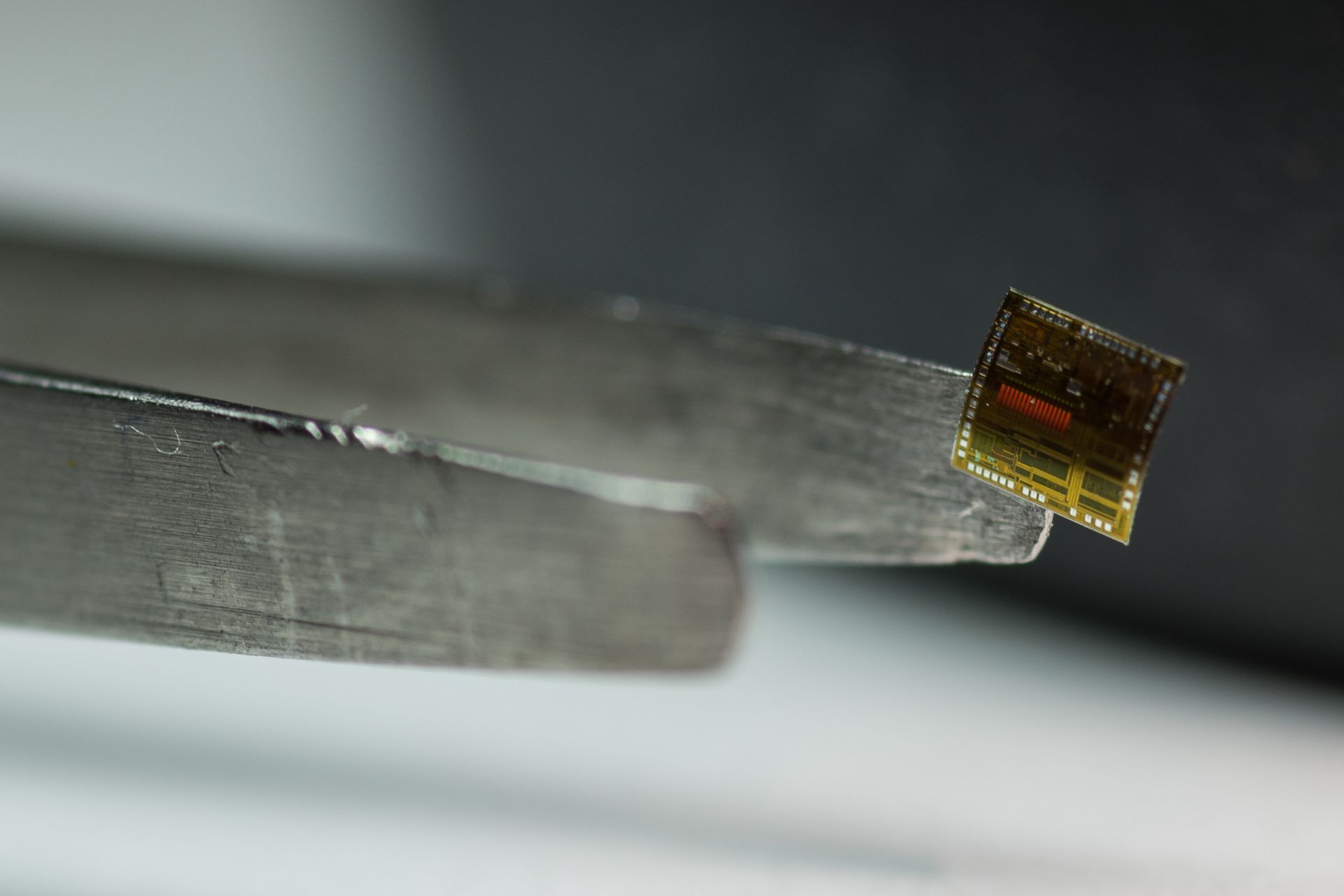

Antimony is used in the manufacturing of armor-piercing ammunition, infrared missiles, nuclear weapons, night-vision goggles, and in civilian technologies such as batteries and solar panels (Picture source: US DoD)

Antimony is a brilliant, silver-colored metal that is rare in nature but critical for the defense industry. It is used in the manufacturing of armor-piercing ammunition, infrared missiles, nuclear weapons, night-vision goggles, and in civilian technologies such as batteries and solar panels. China, which holds 32% of global antimony reserves and produces 48% of the world's supply, has long dominated the global antimony industry. By restricting its exports, Beijing strengthens its control over an already strained global market.

The new rules require licenses for the export of six antimony-related products, including antimony ore, antimony metals, and antimony oxide. Additionally, gold-antimony smelting and separation technologies are now subject to an export ban unless authorized by the Chinese government. While these measures are officially not targeted at any specific country, their impact on the United States, which heavily relies on Chinese antimony imports, will be significant. In 2023, 63% of U.S. antimony imports came from China, rendering U.S. defense vulnerable to these disruptions.

Antimony’s military applications are vast. It is critical for producing flame-retardant materials, making it indispensable for protecting military equipment and armored vehicles. Additionally, its properties make it a key component in semiconductors used in infrared detection systems, radar, and surveillance technologies. In defense, antimony is crucial for ensuring the performance and durability of military systems.

However, it is not only the United States that faces this dependency on antimony. Other major powers, including Europe and Australia, are also feeling the effects of these restrictions. Australia, despite holding large reserves, exports approximately 86% of its antimony to China for processing. Therefore, while Australia may partially fill the gap left by China's restrictions, its ability to independently process these resources remains limited.

China’s strategy fits within a broader framework of protecting critical resources. It also reflects rising tensions over the control of advanced technologies, particularly in the semiconductor industry. China has previously imposed similar restrictions on strategic materials such as gallium and germanium, both essential for producing advanced semiconductors. This use of critical minerals as a geopolitical lever echoes Beijing’s 2010 restrictions on rare earth exports to Japan, which at the time caused significant disruptions in global supply chains.

These restrictions serve as a clear warning to the United States and its allies. The technological rivalry between the two powers continues to intensify, and control over critical resources has become a central issue in this battle. Semiconductors, which are used in many defense technologies, lie at the heart of this conflict. China, attempting to bolster its technological capabilities in response to U.S. sanctions, is leveraging antimony as a new tool of pressure. This allows China to protect its own technological development while complicating U.S. efforts to maintain military superiority.

The U.S. defense industry finds itself in a precarious position. The Department of Defense (DoD) recognizes the strategic importance of antimony, but current stockpiles are limited. By the end of 2022, these stockpiles amounted to only 90 tons, while U.S. annual consumption reached 22,000 tons. This increased dependence on China puts the U.S. in a vulnerable situation. While efforts have been made to diversify supply sources, such as the Stibnite mine project in Idaho, which is supported by the Pentagon, production is not expected to begin until 2028. Until then, the U.S. will need to find solutions to avoid potential disruptions in its antimony supply chain.

China has previously imposed similar restrictions on strategic materials such as gallium and germanium, both essential for producing advanced semiconductors (Picture source: US DoD)

The link between these antimony restrictions and tensions surrounding semiconductors is undeniable. Semiconductors, essential for numerous defense technologies, have themselves become a major geopolitical issue. Taiwan, the world’s leading producer of semiconductors, is at the center of this technological struggle. Control over semiconductor supply chains, which depend on critical materials like antimony, is a key element in the defense strategies of both the U.S. and China. China’s dominant position in the critical minerals market gives it a significant advantage in this battle for control over advanced technologies.

As tensions between the two powers escalate, the question of how the U.S. and its allies will overcome these challenges becomes crucial. Diversifying supply sources, developing recycling technologies to maximize the use of existing resources, and investing in domestic processing capacities are all potential solutions for reducing dependence on China. However, these efforts will take time, and it remains unclear whether the U.S. can adequately shield itself from these restrictions in the near future.

The current situation illustrates a concerning trend: the growing use of resource nationalism and trade restrictions as geopolitical weapons. China has demonstrated its willingness to use its dominance over critical minerals to bolster its position on the global stage, while the U.S. is desperately trying to reduce its dependency. In a world where international cooperation is increasingly scarce, control over critical resources has become a top priority for major powers.

In the long term, these restrictions could have profound consequences. Nations dependent on Chinese resources will need to rethink their supply strategies. International collaboration to develop alternatives to these materials or to expand local production capacities will be essential. However, without a shift in the trade and diplomatic relations between major powers, the world could witness an increasing fragmentation of supply chains, with deep implications for both security and technological innovation.